south dakota sales tax calculator

Most services in South Dakota are subject to sales tax with some exceptions in the construction industry. 31 rows South Dakota SD Sales Tax Rates by City.

The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583.

. The South Dakota SD state sales tax rate is currently 45. Parker Sales Tax Rates for 2022. Searching for a sales tax rates based on zip codes alone will not work.

Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc. The South Dakota Department of Revenue administers these taxes. With few exceptions the sale of products and services in South Dakota are subject to sales tax or use tax.

Just enter the five-digit zip code of the. The state sales tax rate in South Dakota is 45 but you can customize this table as. This takes into account the rates on the state level county level city level and special level.

The State of South Dakota relies heavily upon tax revenues to help provide vital public services from public safety and transportation to health care and education for our citizens. As far as all cities towns and locations go the place with the highest sales tax rate is Box Elder and the place with the lowest sales tax rate is Caputa. The municipal gross receipts tax can be imposed on alcoholic beverages eating establishments.

Municipalities may impose a general municipal sales tax rate of up to 2. South Dakota has recent rate changes Thu Jul 01 2021. Average DMV fees in South Dakota on a new-car purchase add up to 48 1 which includes the title registration and plate fees shown above.

South Dakota Sales Tax. The sales tax rate for Onida was updated for the 2020 tax year this is the current sales tax rate we are using in the Onida South Dakota Sales Tax Comparison Calculator for 202223. Sales tax in Jefferson South Dakota is currently 45.

The one with the highest sales tax rate is 57701 and the one with the lowest sales tax rate is 57703. The state sales tax rate for South Dakota is 45. Cities may impose municipal sales and use tax of up to 2 and a 1.

Depending on local municipalities the total tax rate can be as high as 65. Ad Standardize Taxability on Sales and Purchase Transactions. The sales tax rate for Jefferson was updated for the 2020 tax year this is the current sales tax rate we are using in the Jefferson South Dakota Sales Tax Comparison Calculator for 202223.

If this rate has been updated locally please contact us and we will update the sales tax rate for Onida. Thats where you need a Sales Tax Calculator like ours which will keep you at ease fully satisfied. South Dakota Documentation Fees.

Sales taxes are much more important in the south and west than they are in New England and the industrial Midwest. Please select a specific location in South Dakota from the list below for specific South Dakota Sales Tax Rates for each location in 2022 or. As far as all counties go the place with the highest sales tax rate is Lincoln County and the place with.

South Dakota has 142 special sales. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

The base state sales tax rate in South Dakota is 45. Avalara provides supported pre-built integration. With local taxes the total sales tax rate is between 4500 and 7500.

Sales Tax Rate s c l sr. The average cumulative sales tax rate in the state of South Dakota is 523. ICalculator US Excellent Free Online Calculators for Personal and Business use.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The most populous county in South Dakota is Minnehaha County. Sales tax in Onida South Dakota is currently 65.

If this rate has been updated locally please contact us and we will update the sales tax rate. Sales Use Tax. Integrates Directly w Industry-Leading ERPs.

The most populous zip code in Pennington County South Dakota is 57701. Your household income location filing status and number of personal exemptions. South Dakota has a 45 statewide sales tax rate but also has 289 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1817 on.

Maximum Possible Sales Tax. You can find more tax rates and allowances for Parker and South Dakota in the 2022 South Dakota Tax Tables. South Dakota all you need is the simple calculator given above.

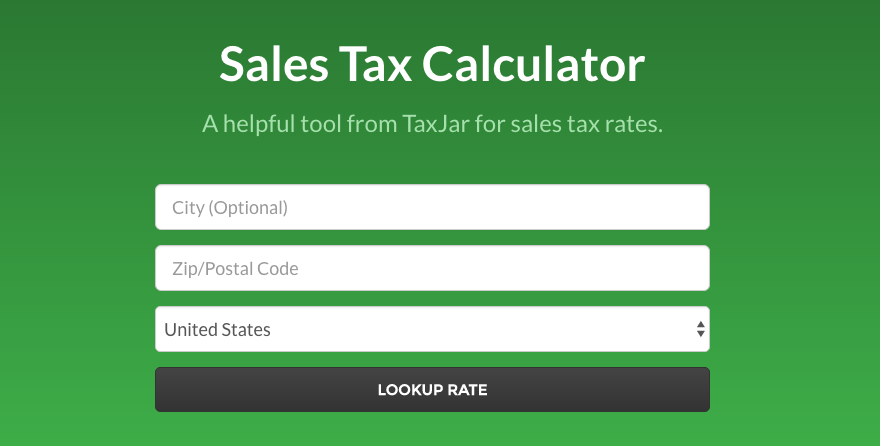

The South Dakota State Sales Tax is collected by the merchant on all qualifying sales made within South Dakota State. Choose the Sales Tax Rate from the drop-down list. How much is sales tax in South Dakota.

If you have any questions please contact the South Dakota Department of Revenue. South Dakota State collects a 0 local sales tax the maximum local sales. Click Search for Tax Rate.

Ad Manage sales tax calculations and exemption compliance without leaving your ERP. South Dakota Department of Revenue 445 East Capitol Ave. Select the South Dakota city from the list of popular cities below to see its current sales tax rate.

Before-tax price sale tax rate and final or after-tax price. Parker in South Dakota has a tax rate of 45 for 2022 this includes the South Dakota Sales Tax Rate of 4 and Local Sales Tax Rates in Parker totaling 05. South Dakota State Sales Tax.

One exception is the sale or purchase of a motor vehicle which is subject to the. For cities that have multiple zip codes you must enter or select the correct zip code for the address you are supplying. The South Dakota State South Dakota sales tax is 450 consisting of 450 South Dakota state sales tax and 000 South Dakota State local sales taxesThe local sales tax consists of.

Enter the Amount you want to enquire about. Enter a street address and zip code or street address and city name into the provided spaces. Local tax rates in South Dakota range from 0 to 2.

Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 6. 54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. 1-800-829-9188 Business Tax Division Email.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. Vehicle Leases Rentals Tax Fact 1 June 2018 South Dakota Department of Revenue Motor Vehicle Sales Purchases Motor Vehicle Sales and Purchases. The Howard South Dakota Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Howard South Dakota in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Howard South Dakota.

Florida Washington Tennessee and Texas all generate more than. They may also impose a 1 municipal gross receipts tax MGRT that is in addition to the municipal sales tax. Maximum Local Sales Tax.

HttpssdgovEPath Mailing address and office location. Other local-level tax rates in the state of South Dakota are quite complex compared against local-level tax rates in other states. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any.

2022 South Dakota state sales tax. So whilst the Sales Tax Rate in South Dakota is 4 you can actually pay anywhere between 45 and 65 depending on the local sales tax rate applied in the municipality. To know what the current sales tax rate applies in your state ie.

For more information on excise taxes related to construction projects consult the South Dakota Department of Revenues site as of this writing excise taxes stand at 2 on gross receipts. Average Local State Sales Tax. Exact tax amount may vary for different items.

The state sales tax rate in South Dakota is 4500.

States With Highest And Lowest Sales Tax Rates

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

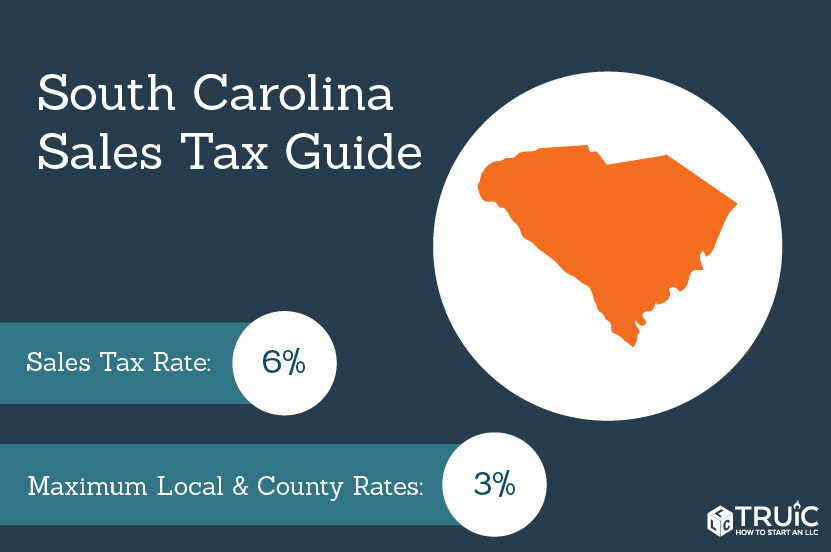

South Carolina Sales Tax Small Business Guide Truic

Sales Tax On Grocery Items Taxjar

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

South Dakota Sales Tax Rates By City County 2022

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Sales Tax Definition How It Works How To Calculate It Bankrate

The Consumer S Guide To Sales Tax Taxjar Developers

Connecticut Sales Tax Calculator Reverse Sales Dremployee

California Tax Calculator Taxes 2022 Nerd Counter

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation